The CryptoGT Index is an Unweighted Price-Index owned and administered by CryptoGT, that is designed to objectively measure the performance of 12 major Cryptocurrencies traded on CryptoGT. It can be used to track the overall growth of the Cryptocurrency Market, serving as a tool for both investors and money managers. The CryptoGT Index can be accessed on the CryptoGT MT5 Desktop, Web and Mobile Terminals via ticker GTi12, and is available for trading 24/7.

GTi12 Constituents

Once a quarter, the CryptoGT Index determines a Cryptocurrency’s eligibility in the Index based on a number of variables, including but not limited to its market capitalization, liquidity, and whether or not it is available for trading on CryptoGT’s trading platforms. It is important to note that stable coins are not taken into consideration.

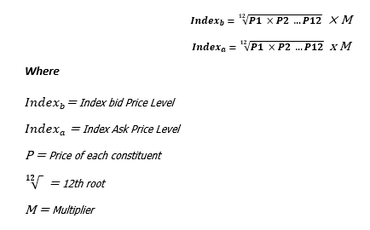

Unlike traditional Price-Weighted Indexes that use simple arithmetic means to track the price movements, which in turn can overstate growth, CryptoGT uses the geometric mean method that is considered to be more appropriate, as it describes both exponential and varying growth over a period of time. This is otherwise known as the compound rate of return. All Cryptocurrencies have an equal impact on the index price.

The Administrator of the Index will review the constituents one week before the end of each quarter to decide whether a Cryptocurrency needs to be replaced, taking into consideration its market capitalization ranking and liquidity, and ensuring that the Index keeps tracking 12 major Cryptocurrencies.

Each constituent’s real time pricing data derives from CryptoGT’s multiple Pricing Sources (Liquidity Providers). The GTi12 algorithm calculates the Index bid and ask prices for each constituent making up the Index’s buy or sell value (Top of the Book). The Index is rounded to four decimals.

Initial Multiplier is 1 and it will be revised every time a constituent is replaced. The new multiplier will be published here.

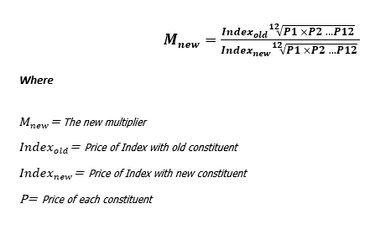

The replacement of a constituent should not have an impact on the price level of the Index. If the Index closes at $20 at the end of a quarter and a Cryptocurrency is replaced with another Cryptocurrency in order for the Index to constitute the top 12 Cryptocurrencies by market capitalization, the Index will re-open at $20. This is achieved by adjusting the multiplier.

The new multiplier is calculated using the following formula:

The new multiplier is calculated using the following formula:

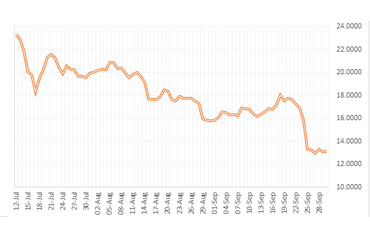

The above chart indicates a daily historical performance for informative purposes only and gives no indication of future outcome.

If coin prices are unavailable due to unforeseen events, the Index will be calculated using the most recently updated prices. If a currency price is unavailable for more than two consecutive Index Business Days, CryptoGT reserves the right to remove the Constituent from the Index and perform an extraordinary reconstitution. In such a scenario the Administrator in conjunction with the risk team reserves the right to pause trading in order to protect investors’ interest, and it cannot be held responsible for any losses incurred.

CONSTITUENTS HISTORICAL LOG

| Constituent | Constituent Date |

|---|---|

| BTC | From July 12, 2019 |

| XRP | From July 12, 2019 |

| ETH | From July 12, 2019 |

| LTC | From July 12, 2019 |

| XLM | From February 16, 2021 |

| DOT | From February 16, 2021 |

| BNB | From July 12, 2019 |

| TRX | From July 12, 2019 |

| ADA | From July 12, 2019 |

| SOL | From February 28, 2022 |

| MAT | From February 28, 2022 |

| BCH | From May 11, 2022 |

| Date | Old Multiplier | Old Constituent | New Multiplier | New Constituent |

|---|---|---|---|---|

| From July 12, 2019 | 1 | N/A | 1 | N/A |

| From February 16, 2021 | 1 | DSHUSD, XMRUSD | 1.995 | DOTUSD, XLMUSD |

| From February 28, 2022 | 1.995 | BCHUSD, EOSUSD, BSVUSD | 2.30 | SOLUSD, LUNUSD, MATUSD |

| From May 11, 2022 | 2.30 | LUNUSD | 1.46 | BCHUSD |

The Index is designed and calculated to strictly follow the rules of this methodology and it might not be representative in every case, nor achieve its stated objective in all instances. The Cryptocurrency market can be extremely sensitive to market volatility and liquidity, and this can have a major impact on the quality or amount of data available to the Index’s algorithm. In such cases, the Index might produce unpredictable or unforeseen results.

Furthermore, prices are received from third party sources for the purpose of forming the Index’s value, therefore, any interruptions in price data beyond the Administrator’s control, can cause interruptions in pricing, and CryptoGT can not be held responsible in any case.

In addition, there are other several risks associated with the valuation of the Index such as, interruption of trading, distributed denial of service, hacking, cross-national legal environment, unstable technological environment and suspension of market trading in Cryptocurrencies which might have a major impact on the Index’s Value.

In addition, there are other several risks associated with the valuation of the Index such as, interruption of trading, distributed denial of service, hacking, cross-national legal environment, unstable technological environment and suspension of market trading in Cryptocurrencies which might have a major impact on the Index’s Value.

This website cryptogt.com is owned and operated by Hatio Ltd. Hatio Ltd is a registered company in Marshall Islands, with registration number 90645 and has its registered address on Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Republic of the Marshall Islands MH96960.

Cryptocurrency trading can be extremely risky and can lead to large and immediate financial losses. Crypto assets are highly volatile and can result in significant losses of your capital over a short period of time. Cryptocurrencies markets are unregulated services which are not governed by any specific regulatory framework. The provision of such services is not being directly provided by the Company but through licensed third parties.

CryptoGT does not provide its services to residents of various jurisdictions such as but not limited to the United States of America, North Korea and Cuba.

CryptoGT currently accepts only cryptocurrencies as method of deposit.

Cryptocurrency trading can be extremely risky and can lead to large and immediate financial losses. Crypto assets are highly volatile and can result in significant losses of your capital over a short period of time. Cryptocurrencies markets are unregulated services which are not governed by any specific regulatory framework. The provision of such services is not being directly provided by the Company but through licensed third parties.

CryptoGT does not provide its services to residents of various jurisdictions such as but not limited to the United States of America, North Korea and Cuba.

CryptoGT currently accepts only cryptocurrencies as method of deposit.