Date:

11th Jan 2021

What Institutional Investors Say About Bitcoin Prospects in 2021

Article Table of Contents:

How High Could Bitcoin Rise?

Growing Institutional Adoption in 2021

A Counter to Inflation

Not Without Risks

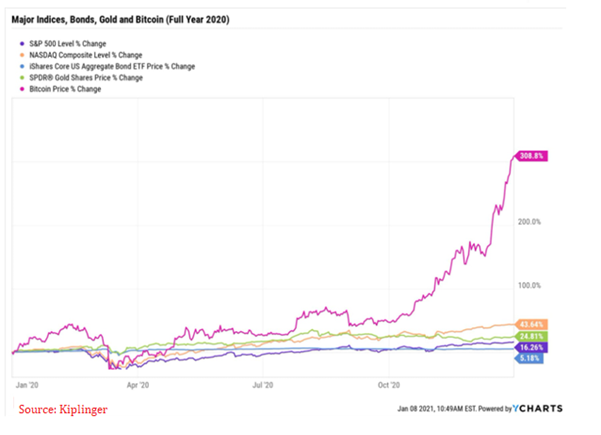

Following in the footsteps of a momentous year, Bitcoin started 2021 with a bang. The cryptocurrency was trading below $4,000 in March, when the pandemic hit the world. It had gained 224% by mid-December, ending the year at over $29,000. The surge was even more marked in 2021, with Bitcoin rising from $29,000 on January 1 to crossing the $40,000 market by January 7. Although the digital currency dropped below $40K in the second week of the year and experienced further drops likely due to profit taking, crypto enthusiasts are still optimistic regarding BTC’s prospects for the year.

Growing Institutional Adoption in 2021

A Counter to Inflation

Not Without Risks

Following in the footsteps of a momentous year, Bitcoin started 2021 with a bang. The cryptocurrency was trading below $4,000 in March, when the pandemic hit the world. It had gained 224% by mid-December, ending the year at over $29,000. The surge was even more marked in 2021, with Bitcoin rising from $29,000 on January 1 to crossing the $40,000 market by January 7. Although the digital currency dropped below $40K in the second week of the year and experienced further drops likely due to profit taking, crypto enthusiasts are still optimistic regarding BTC’s prospects for the year.

Given Bitcoin’s stellar performance through a year that was tumultuous for most other types of assets, analysts are increasingly showing an interest in the cryptocurrency. So much so that it is commonplace today to see BTC price targets being forecast. Some of these price targets appear outright outrageous.

For instance, Willy Woo, former partner at Adaptive Capital, believes that $200,000 would be a “conservative estimate for BTC USD by the end of 2021. Woo is really on the middle path. Stock-to-Flow predicts $100,000 and Mike McGlone of Bloomberg has set his target at $170,000. On the other hand, Citibank analyst Tom Fitzpatrick calls Bitcoin “21st century gold,” predicting that the crypto could rise to $318,000 by the year end.

Compared to these forecasts, BTIG analyst Julian Emanuel’s price target of $50,000 seems very restrained.

Whatever their prediction, analysts do appear to agree on one thing – 2021 will be characterised by news that will drive Bitcoin’s price higher. While some expect continued FOMO among retail investors, others point to the increasing institutional interest in the crypto space. So, what’s making the analysts so optimistic?

For instance, Willy Woo, former partner at Adaptive Capital, believes that $200,000 would be a “conservative estimate for BTC USD by the end of 2021. Woo is really on the middle path. Stock-to-Flow predicts $100,000 and Mike McGlone of Bloomberg has set his target at $170,000. On the other hand, Citibank analyst Tom Fitzpatrick calls Bitcoin “21st century gold,” predicting that the crypto could rise to $318,000 by the year end.

Compared to these forecasts, BTIG analyst Julian Emanuel’s price target of $50,000 seems very restrained.

Whatever their prediction, analysts do appear to agree on one thing – 2021 will be characterised by news that will drive Bitcoin’s price higher. While some expect continued FOMO among retail investors, others point to the increasing institutional interest in the crypto space. So, what’s making the analysts so optimistic?

Growing Institutional Adoption in 2021

A key reason for the upbeat price target could be the growing institutional interest in Bitcoin. On the one hand, Coinbase, a crypto exchange, expects to go public in 2021. The exchange stated that its institutional asset base had risen from $6 billion in April 2020 to $20 billion by mid-November.

On the other hand, 2020 was witness to some exciting crypto events. JP Morgan Chase took its alt coin, the JPM Coin, live in October, Stanley Druckenmiller finally accepted that he had invested in BTC and insurance company MassMutual bought $100 million worth of Bitcoin. PayPal adding the crypto to its payment options didn’t hurt either. Even famed hedge fund manager and billionaire, Ray Dalio, stated in December 2020 that Bitcoin should be part of every investor’s portfolio.

On the other hand, 2020 was witness to some exciting crypto events. JP Morgan Chase took its alt coin, the JPM Coin, live in October, Stanley Druckenmiller finally accepted that he had invested in BTC and insurance company MassMutual bought $100 million worth of Bitcoin. PayPal adding the crypto to its payment options didn’t hurt either. Even famed hedge fund manager and billionaire, Ray Dalio, stated in December 2020 that Bitcoin should be part of every investor’s portfolio.

A Counter to Inflation

With the pandemic-led economic slowdown and the response of central banks in terms of printing the domestic currency to put money in people’s pocket, inflation will become a reality sooner, rather than later. However, Bitcoin, like gold, remains relatively unaffected during such periods when the fiat currency market is under pressure. This makes the cryptocurrency a viable hedge against inflation.

Previous financial crises bear witness to such hedging. Fears of inflation, following the 2008 crisis resulted in a surge in gold price in 2011. Just like Bitcoin, gold also set records in 2020, reaching a value of $2,070 per ounce. However, while the precious metal pulled back and stayed around the $1,800 mark towards the end of the year, Bitcoin continued to soar.

Previous financial crises bear witness to such hedging. Fears of inflation, following the 2008 crisis resulted in a surge in gold price in 2011. Just like Bitcoin, gold also set records in 2020, reaching a value of $2,070 per ounce. However, while the precious metal pulled back and stayed around the $1,800 mark towards the end of the year, Bitcoin continued to soar.

Not Without Risks

Although the future might seem bright for Bitcoin, the cryptocurrency isn’t without its own share of risks. One of the biggest risks to this unprecedented bull run could be an increase in regulatory hurdles. We already know that US President-Elect, Joe Biden, is likely to prioritise the crypto regulation during the first 90 days of taking office.

In addition, central bank digital currencies (CBDCs) could well become a reality in the near future. If cryptocurrencies are accepted as legal tender, regulatory oversight is only likely to be more stringent. Whether Bitcoin’s decentralised nature helps it win over CBDCs is something we will need to wait and watch.

Do you agree that 2021 could be the Year of Bitcoin? Connect with us and share your thoughts.

In addition, central bank digital currencies (CBDCs) could well become a reality in the near future. If cryptocurrencies are accepted as legal tender, regulatory oversight is only likely to be more stringent. Whether Bitcoin’s decentralised nature helps it win over CBDCs is something we will need to wait and watch.

Do you agree that 2021 could be the Year of Bitcoin? Connect with us and share your thoughts.

This website cryptogt.com is owned and operated by Hatio Ltd. Hatio Ltd is a registered company in Marshall Islands, with registration number 90645 and has its registered address on Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Republic of the Marshall Islands MH96960.

Cryptocurrency trading can be extremely risky and can lead to large and immediate financial losses. Crypto assets are highly volatile and can result in significant losses of your capital over a short period of time. Cryptocurrencies markets are unregulated services which are not governed by any specific regulatory framework. The provision of such services is not being directly provided by the Company but through licensed third parties.

CryptoGT does not provide its services to residents of various jurisdictions such as but not limited to the United States of America, North Korea and Cuba.

CryptoGT currently accepts only cryptocurrencies as method of deposit.

Cryptocurrency trading can be extremely risky and can lead to large and immediate financial losses. Crypto assets are highly volatile and can result in significant losses of your capital over a short period of time. Cryptocurrencies markets are unregulated services which are not governed by any specific regulatory framework. The provision of such services is not being directly provided by the Company but through licensed third parties.

CryptoGT does not provide its services to residents of various jurisdictions such as but not limited to the United States of America, North Korea and Cuba.

CryptoGT currently accepts only cryptocurrencies as method of deposit.